My Experience with Turbo Tax

19/04/11 07:21 Filed in: Technology

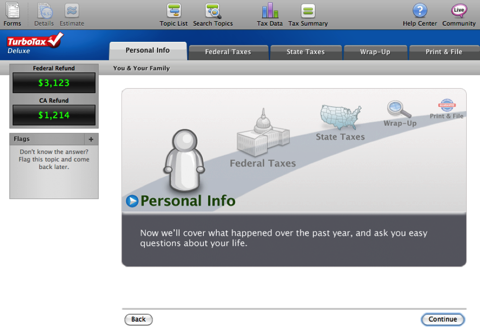

Start Up

When you first start up Turbo Tax it asks if you want to import data from your previous year’s taxes. Since I had my 2009 Turbo Tax file on my computer the program found it and began to import it. Once it had finished the import and recent software updates it took me to the Personal Information Screen and there was all my personal data just as I had entered it last year including social security numbers. I love the fact that I did not need to look anything up to have to fill out the same information again. It was all imported for me.

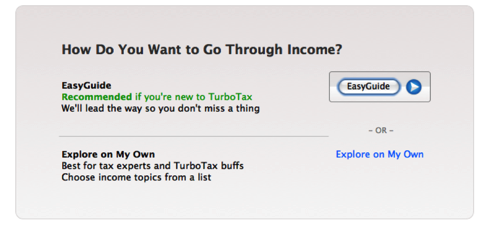

The Easy Wizard

From there Turbo Tax walks you through a series of questions that help you to determine what your income figures and deductions are. I love the fact that everything I had put in last year was already filled in for me. I just had to update my W2 forms and the actual numbers I received from all my financial institutions and figures from my wife’s home business. Everything was right there and the process was smooth.

Error Check

Once you have put all your information in, the program checks to make sure nothing is missing or out of place. If it finds something that you are missing it comes back asking you questions to help you finish putting in anything my may have missed. If you get stuck and are not sure if you should fill in that information or want to know where it is on the form you can simply click the form button on the top left of the window and you are taken to a screen that shows all the forms that will be used on the left and an actual editable form on the right. Any form that is missing information has a red exclamation point next to it. Once you update that information the red exclamation point goes away letting you know you are all set. This adds confidence as you know the system is checking all the bases.

State Filing

The state filing was also very well put together and up to date. Everything from my Federal Tax form was transferred to my state form so I had very little to input. I live in a state that requires you to pay taxes on purchases you made out of state or on the internet. Turbo Tax had that information available for input complete with each counties tax rate making it easy to input. The same error correction that is available on the Federal tax portion was available for the state portion as well.

Print & E-File

When you are all done with your tax preparation you are asked if you are ready to file your taxes. Before you file you have the opportunity to review and print the actual tax forms. I usually save the files as pdf’s so have them with all of my other forms electronically. You are then asked if you want to e-file or mail your forms in. I choose e-file due to speed of my return. The E-file information is pre-filled out from last year including my bank information and how I paid for the state e-file last year. So all I had to do was confirm the information and send it off. The beauty of Turbo Tax is the fact that they update you every step of the process. You get an email telling you your returns were filed. You also get emails telling you the government accepted your return and have in their possession. You can then check where your return is in the process all the way to the point where your check is mailed. Pretty cool stuff!

Overall I am pleased with my experience with Turbo Tax. The ability to do my taxes myself in a couple of hours for a fraction of the price I was paying an accountant makes it a great deal. The software does a good job covering all the bases including my tax status as a Minister which has it’s own set of complexities. I would highly recommend it if you have a pretty straight forward tax situation and are tired of paying an accountant.

blog comments powered by Disqus